TRX Price Prediction: Can It Reach $1 Amid Technical Strength and Market Shifts?

#TRX

- TRX shows technical strength trading above key moving averages

- Regulatory developments may create favorable conditions for crypto assets

- Competitive pressures from DeFi innovations could limit upside potential

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerging

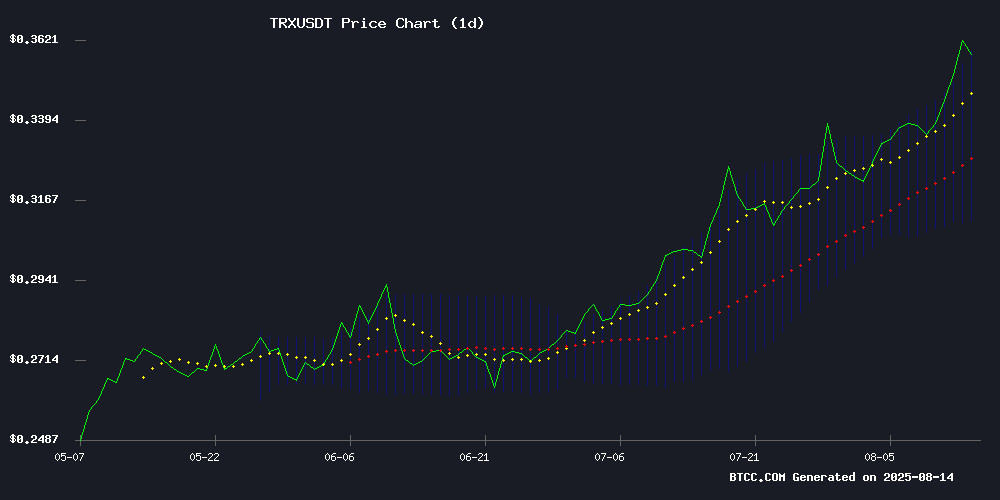

TRX is currently trading at 0.3586 USDT, above its 20-day moving average (0.3349), indicating a potential bullish trend. The MACD histogram shows a slight convergence (-0.001304), suggesting weakening downward momentum. Bollinger Bands reveal price hovering NEAR the upper band (0.358866), signaling strong buying interest. According to BTCC analyst Michael, 'TRX's technical setup favors upside potential, with a break above 0.36 likely triggering further gains.'

Regulatory Shifts and DeFi Competition Shape TRX Outlook

The White House's crackdown on bank discrimination could indirectly benefit crypto assets like TRX as investors seek alternative financial systems. Meanwhile, rising competition from new DeFi projects like Unilabs may pressure TRX's market share. Michael notes, 'While regulatory tailwinds exist, TRX must demonstrate ecosystem growth to maintain its position against emerging DeFi rivals.'

Factors Influencing TRX's Price

White House Crackdown on Bank Discrimination Could Spark Crypto Rally

The Biden administration is drafting an executive order to penalize financial institutions that arbitrarily cut services to cryptocurrency firms. This move addresses 'de-banking'—where companies face account closures without legitimate financial cause—potentially removing a significant barrier to mainstream crypto adoption.

Four digital assets stand to benefit disproportionately from this regulatory shift. Little Pepe (LILPEPE), the meme coin phenomenon, has already demonstrated explosive growth with a 90% price surge post-launch. ethereum (ETH) shows accelerating institutional accumulation reminiscent of its 2016 breakout pattern. Ripple (XRP) gains momentum as legal clarity converges with growing cross-border payment adoption. Tron (TRX) continues expanding its DeFi footprint through robust on-chain activity and stablecoin dominance.

Regulators will enforce the policy through existing financial statutes, including the Equal Credit Opportunity Act. Violations could trigger monetary penalties, consent decrees, or Department of Justice referrals—a deterrent likely to reshape banking attitudes toward crypto businesses.

New DeFi Coin Unilabs Gains Market Share as TRX and SOL Face Competitive Pressure

Unilabs, a nascent DeFi token, has surged 30% post-listing on CoinMarketCap, carving out market share from established players like TRON and Solana. The project's $12.8M ICO and perceived utility advantages position it as a high-growth contender despite SOL breaching $200 and TRX crossing $0.35.

Technical analysts spotlight Tron's bullish trajectory, with Intuit_Trading projecting a September rally to $1 following historical patterns of post-bear trap recoveries. Javon Marks reinforces this outlook with a $1.11 price target, while short-term forecasts suggest an imminent test of $0.45.

Will TRX Price Hit 1?

Based on current technicals and market conditions, TRX faces both opportunities and challenges in its path to $1:

| Factor | Impact |

|---|---|

| Technical Position | Bullish (Above MA, MACD improving) |

| Regulatory Environment | Potentially favorable |

| Competitive Pressure | Growing from DeFi alternatives |

Michael suggests, 'While $1 represents a 179% increase from current levels, achieving this would require sustained bullish momentum and significant ecosystem adoption. Short-term targets should focus on breaking 0.40 resistance first.'

0.3586

179